This year will be an exciting one for watch collectors. The currents are shifting, and changes are afoot.

Kicking off the year, all the big Swiss name brands are cautious about the slowing Asian luxury market, not to mention the impact of a volatile Swiss Franc. The smaller fish and independent brands are jockeying for position too. Meanwhile the vintage watch market is becoming more challenging for collectors and enthusiasts than ever before.

The timepiece market has certainly changed a lot since I first became interested in watches. From my vantage point at Dubai’s specialist luxury watch boutique I’ve noticed an interesting trend: I’ve seen an ever greater number of well-educated buyers who aren’t prepared to settle for second best.

In the past there were only a handful of what I would call ‘true collectors’, and the average watch buyer was a little ignorant about the genuine marks of quality in a fine watch. But things have changed. These days many more buyers know their Tourbillons from their Fly Wheels, and the number of serious collectors has grown tremendously.

There are plenty of resources for collectors online, and the number of specialist horology blogs available means that anyone can become an expert, given a little time and dedication. The influence of this can be felt through every tier of the market.

My predictions for the year to come:

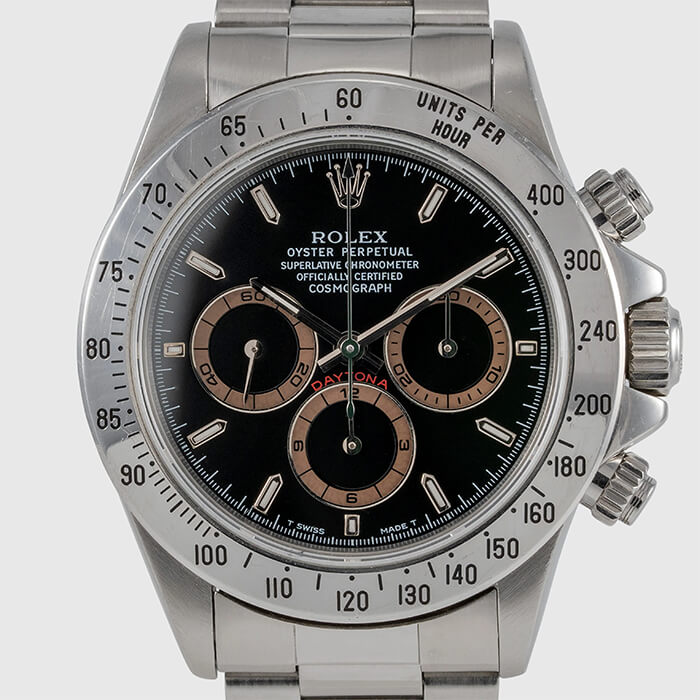

In general there’s been a shift in emphasis from the well-known names to the lesser-known brands. Apart from Rolex and Patek Philippe there are many brand names that are now coveted by serious collectors. For example: I’ve seen a large number of high quality Chronographs from Universal Geneve, Omega and Longines take to the skies, compared to the sales trends of previous years.

2016 will bring a switch in market dynamics, with many brands offering cheaper alternatives to their flagship products. This is inevitable, given the recent developments in buying trends. Bigger brands, like those belonging to the Richemont group are able to absorb the effects of a slowing market easier than smaller brands. But the industry is in a state of flux, and many are taking steps to adjust. At least five brands, including De Bethune, Greubel Forsey and Parmigiani, let go of their chief executives in 2015.

Although the number of buyers might not increase, I expect vintage watches to continue to break records at the top auction houses, and that there will be more demand for second-hand watches of immaculate quality in good condition.

While discussing these trends with my good friend and fellow watch enthusiast over at Le Monde Edmond I got the low down from him. He shared the insights he gleaned from a number of watch aficionados, including Aurel Bacs, Founder of Bacs & Russo and Senior consultant to Phillips watch department:

“I wouldn’t be surprised to see softer prices for contemporary “commodity-style” watches where the supply is likely higher than the demand. In the arena for great vintage pieces, where the opposite is the case, I expect to see the values to go up, not only for the gold-standards of the industry like Patek Philippe and Rolex, but also many other historical manufacturers like Vacheron Constantin, Audemars Piguet, Longines, Jaeger LeCoultre and IWC.”

From my personal experience, I can agree. One trend is unmistakable: Rare, high-quality pieces from many lesser-known brands are in demand. Even with the challenges and the financial realities of the market, collectors are still willing to pay the premium for top tier watches.

This is even more important in the vintage market. The gap is widening between vintage watches of the ‘regular’ scratched and rather common variety, and the finest rare examples in mint condition.

So, to sum it up, while there might be some bad news for the watchmakers this year, particularly the up-and-coming variety, it’s all good news for the collector. If you’re not already looking, it might be time to study up on your horology and get down to the next watch auction!