If you bought a Rolex Daytona with a Paul Newman dial in 1970, looked well after it over the years and still were in possession of it today, then you might have had a good chance to auction it today and make a killing out of it.

A few highlights since 2013 include the rare 1942 Rolex Split-Chronograph (of which only 12 were ever made) which sold for $1.17 Million at Christie's or the 1971 Rolex Daytona Ref.6263 Albino that belonged to Eric Clapton and sold for over $1.5 Million at Christie's in Geneva. Results from the Phillips Day Date Auction also shout for a new world record, a Day Date for over $500,000!

Now if that applied to all Rolex watches, we would not be that excited about it. The secret is to know what makes these watches so special: when and how does a Rolex qualify as collectible and become expensive and sought after and last but not least an investment? At Momentum, we take a personal interest in this topic, and we’d like to share a few insights.

The value of rare vintage timepieces has continued to grow, despite the worldwide economic pressures. Rolex is one of the most consistent brands when it comes to the having the power to maintain its value, and show a good return, as far as investments go. The brand has established itself through innovation and introduction of world's firsts, such as the first waterproof watch, the first watch with a day and date window on the dial and many more. Collectors and connoisseurs appreciate the milestones the company has reached over the years and most importantly, there are stories behind the watches, important stories. Each model has its own background and was produced with a certain background, a special need in the market. All that paired with a consistent high quality throughout the years since the 1920’s.

Here are the most important factors influencing the value:

True Vintage: The question here is, what is vintage. It is not only the era (1920s-1990s) which makes a watch vintage, it is the story behind it, the collectability and the rareness. Even slightly newer watches qualify as vintage if they are ‘important’ watches if they are iconic.

History: One of the most important aspects affecting selling price is the unique history of the watch. If someone famous owned it, gave it as a gift or wore it on a movie set or a race track, you can be sure that the value will go up. Rolex has featured in the lives of many famous personalities, and in plenty of newsworthy events – this was part of their marketing strategy all along. A Rolex with historical provenance will be among the most important ones.

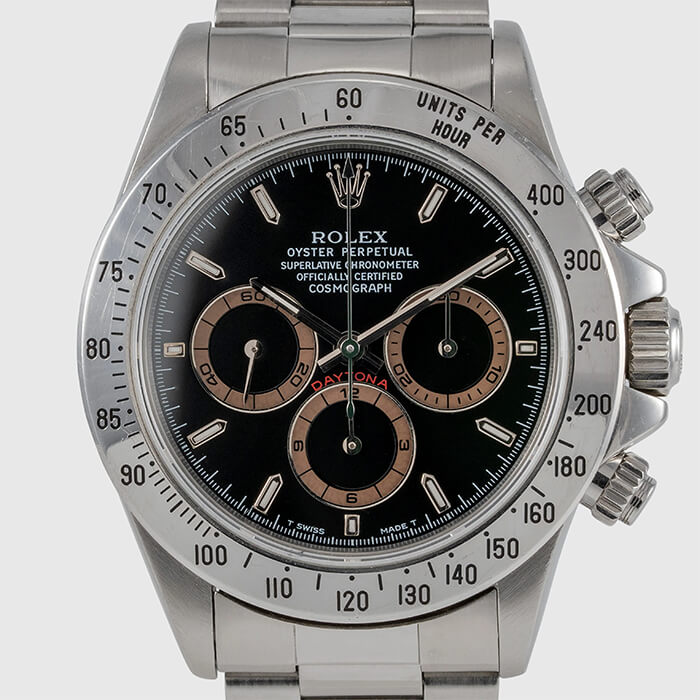

Condition: Often Rolex produced timepieces using only the highest quality of materials, including gold, silver, and diamonds, but this isn’t always the case. In fact, some of the priciest Rolex models ever sold were made from steel. It’s important to have a watch in good and most importantly original condition. The replacement of original components affects the value and collectability immensely.

Paperwork: Original documents and packaging, including certification, are sure to increase the value of the watch tremendously. Look after these as carefully as the timepiece itself!

Rarity: The fewer watches released to the market originally, the more valuable the watch tends to become after time. Some models were made in very limited numbers, making them all the more rare and valuable to the collector.

In conclusion, it is wise to be educated on the subject when purchasing a vintage Rolex as an investment. Not all Rolex models will turn out to be equally lucrative deals but most of them will retain their value to the best. It’s always best to get some expert advice on the topic and to spend time before the purchase. But then, of course, buying a watch is often more of an emotional thing than an intellectual one –why not get the best of both worlds?